Practices › Food safety & TIC › GMO Testing Market

GMO Testing Market

The market for GMO testing has grown exponentially in the last few years. The market size is projected to reach USD 2.34 Billion by 2022, at a CAGR of around 8.2% from 2017 to 2022. Both, developed and developing countries have been targeted for this industry as the consumer concerns toward GMOs have been revolutionizing the GMO testing technology. Need to ensure sufficient nutrition, evolution in farming technology, labeling mandates in several countries, diverse GM processed food production, and high investments in biotech R&D have been driving the market for GMO testing.

The GMO testing market, on the basis of trait, is segmented into stacked, herbicide tolerance, and insect resistance. The stacked trait testing market accounted for the largest in 2016, and is projected to be the fastest-growing in GM testing for crops and foods due to the increase in R&D innovations and multiplicity of different traits in one crop or food. Also, the expenses and the procedure associated with the testing stacked trait are higher.

The GMO testing market, on the basis of technology, is segmented into polymerase chain reaction (PCR) and immunoassay. The PCR segment accounted for the largest market in 2016, and is projected to grow at the highest CAGR from 2017 to 2022. The GMO testing market is segmented into crop and processed food tested, where the testing market for crops accounted for the largest. The crop segment is further subsegmented into corn, soy, rapeseed/canola, and potato, for which the testing for corn and soy accounted for the largest, and is projected to be the fastest-growing, as these are largely traded crops. The processed food tested segment includes bakery & confectionery, meat & meat products, breakfast cereals & snacks, food additives, and others, of which breakfast cereals & snacks is projected to be the fastest-growing market for GMO testing.

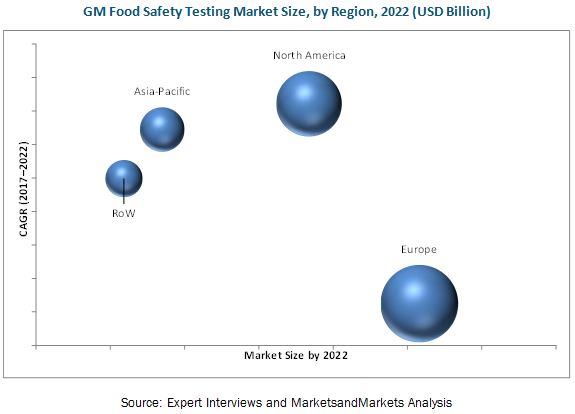

The GMO market was dominated by the European region in 2016. Stringent regulatory affairs for GMO testing and consumers’ disapproval toward GM foods have been driving the market in European countries such as Germany, the U.K., Spain, and France. North America is projected to be the fastest-growing region for GM food safety testing, as it is the largest GM crops producing country, along with the need to comply with the GMO labeling regulations from importing countries. The active U.S. players in this market are Thermo Fisher Scientific, Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Mérieux NutriSciences Corporation (U.S.), EMSL Analytical Inc. (U.S.), Microbac Laboratories, Inc. (U.S.), Genetic ID NA, Inc. (U.S.), and OMIC USA Inc. (U.S.)

Lack of proper implementation of regulations, lack of technical know-how among farmers, ban on the production of GM crops, and unaffordability of tests by food manufacturers & channel members are the major restraints and challenges in the GM food testing market for safety.

One of the leading players, Intertek Group Plc (U.K.), adopted acquisitions as its key strategy; it also focuses on expansions to extend its capabilities in the GMO testing market. The company has been continuously improving its products and services through new and advanced technologies to create new opportunities in food industries.

In 2016, Intertek acquired the Italian company Food International Trust (FIT-Italia), which provided a wide range of assurance, testing, and certification services. It was the first Italian company to receive ISI accreditation as an inspection body for the food sector and the first company in Italy to be accredited to deliver the International Food Standard (IFS) Food Store program. In March 2016, Eurofins Scientific invested in the expansion of its global infrastructure for advanced testing laboratories; it invested USD 800 million in 2016. Through these laboratories, the company would provide services such as food and microbiology testing.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst