Practices › Transmission and Distribution › Utility Drones Market

Utility Drones Market

The global utility drones market is estimated to be USD 110.2 million in 2018 and is projected to reach USD 538.6 million by 2023, at a CAGR of 37.34% from 2018 to 2023. Rising demand for minimizing outages related to transmission & distribution infrastructure, focus on time and cost efficiency, and reachability in hazardous locations are the major drivers of the utility drones market.

The report segments the utility drones market, by services, into end-to-end solution and point solutions. The end-to-end solution segment is expected to dominate the market in 2018 because of the availability of expertise required to obtain accurate data on utilities assets. This solution includes the provision of the drone; drone pilots; engineers; software; data management, processing, and analytics; drone advisory services; and consulting, among several other services.

Based on end-user, the utility drones market has been segmented into power and renewable. The power segment is expected to hold the largest market share in 2018. The advantages of using utility drones for the power industry include cutting down of operation and maintenance costs; boosting of worker safety considering their ability to fly in potentially dangerous areas; use of little or no fuel; and negligible environmental impact. All these are the key factors driving the power end-user segment of the utility drones market during the forecast period.

Based on type, the utility drones market has been segmented into multi-rotor and fixed wing. The multi-rotor segment is estimated to lead the market in 2018 and is expected to grow at the fastest rate during the forecast period, as multi-rotors are comparatively cheaper and readily available in the market.

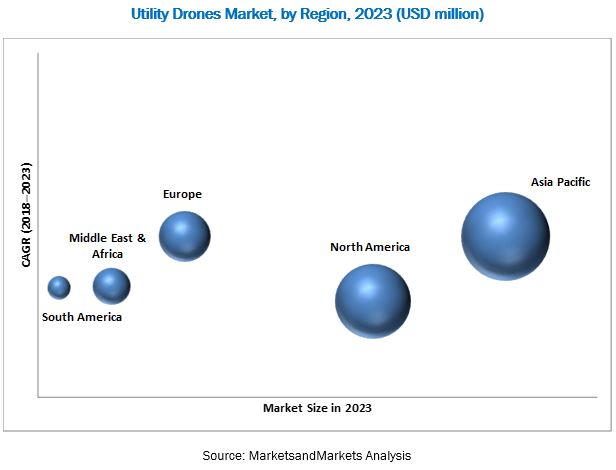

In this report, the utility drones market has been analyzed with respect to 5 regions, namely, Asia Pacific, Europe, North America, South America, and Middle East & Africa. The North American region is expected to hold the largest market share in 2018 and is the fastest growing market from 2018 to 2023. Factors such as increased investments in power infrastructure, rising power consumption, and increasing focus on renewable power generation in the energy mix are driving the utility drones market in the North American region.

Advancements in drone technology and amendments in drone regulations, permitting BVLOS flights can create opportunities in the utility drones market. However, legal regulations could restrain the growth of the market, leading to declining profits.

Some of the leading players in the utility drones market are Cyberhawk (Scotland), Delair (France), Measure (US), PrecisionHawk (US), and HEMAV (Spain). Contracts & agreements and partnerships were the most widely adopted strategies by players to ensure their dominance in the market.

Opportunities

Amendments in drone regulations, permitting BVLOS flights

BVLOS flights represent vast opportunities for the utility drone market. Considering the worldwide pressure by public utility companies on FAA for permitting or at least easing out regulations regarding BVLOS, there are high chances that the coming years would see more countries allowing BVLOS flights. Many countries have already started updating their regulatory frameworks regarding BVLOS flights, hence allowing them to utilize the full potential of the utility drones. Countries such as Australia, Czech Republic, Denmark, the UK, the US, Sri Lanka, and Brazil have initiated the testing of BVLOS flights with prior approvals. For instance, in Denmark, “BVLOS flights may only be performed with prior permission from the Danish Transportation Authority” as quoted by the Danish Transportation Authority; in Canada, “For BVLOS operations…specific weather requirements…are determined on a case-by-case basis. The minimum meteorological conditions must be suitable to allow the safe departure and arrival of the aircraft” – as quoted by Transport Canada.

Advancements in drone technology

Companies around the world have been consistently working on one prime issue faced with drones battery performance. Considering that drones can be operated only for a couple of minutes, their makers are trying to improvise on various parameters to allow longer flight durations, hence cutting down costs further. On the other hand, battery manufacturers have also been in the pursuit to come up with innovative solutions to enhance the battery life, and eventually the overall flight time of drones. For instance, a start-up from Massachusetts named SolidEnergy Systems has been working on lithium metal batteries, which are expected to provide twice as much power as opposed to the conventional lithium-ion batteries.

Challenges

Working safety

Adoption of drone technology, by the utilities and also other sectors, is growing at a very fast pace. This can lead to problems in tackling air traffic, increasing the risks related to collisions and other related aviation accidents. In case of malfunctioning, such as loss of power or loss of signal between the pilot and the drone, the incidents can pose major threats to the public. For utility companies, a minor malfunctioning can lead to drones crashing onto their assets (e.g., power lines) and can lead to a disruption in electricity supply while also severely damaging the equipment.

Data protection and security

Since drones capture enormous amount of data, for utilities in this case, there are concerns regarding the protection and safety of confidential data from potential hackers. Cybersecurity is of utmost importance to drones and the related software industry. Although data hacking from drones has not been a big issue, there are still chances of data vulnerability if drones are connected to the internet. Such cyber issues have been overcome by some companies, such as Sharper Shape, which use cloud technology to process and maintain sensitive data. However, there are utility companies that still rely on old-school methods of data protection and have not adopted modern day cloud-based solutions.

Mergers & Acquisitions

|

Date |

Company Name |

Development |

|

March 2018 |

Aerodyne |

Aerodyne bought a 60% controlling stake in wind turbine blade inspection company AtSite for Euros 2.2 million. |

|

February 2018 |

PrecisionHawk |

PrecisionHawk acquired Droners.io and AirVid. The acquisition was aimed at launching the nation’s largest network of commercially licensed drone pilots. |

Collaborations & Alliances

|

Date |

Company Name |

Development |

|

September 2017 |

Sharper Shape |

Sharper Shape and SkySkopes, in cooperation with an investor-owned utility, utilized Sock pulling for power-line construction. The mission used the Sharper A6 UAS to string sock lines for a 675-kV line construction project. |

|

September 2017 |

PrecisionHawk |

McCarthy collaborated with PrecisionHawk to develop customized tools and services aimed at expanding the use of drones across field solutions, BIM, survey, and risk management. |

To speak to our analyst for a discussion on the above findings, click Speak to Analyst