Practices › Display Technology › Display Material Market

Display Material Market

The display material market was valued at USD 28.87 Billion in 2017 and is expected to reach USD 34.60 Billion by 2023, at a CAGR of 3.1% between 2017 and 2023. Construction and upgrade of display panel manufacturing plants in APAC, increasing average screen size and resolution of television units, and increased adoption of OLED display technology in various applications significantly drive the market growth. High growth of OLED and quantum dot LCD displays and emerging technologies such as micro-LED and true quantum dot are expected to provide good growth opportunities for display material providers in the future.

The LCD held a larger share of the market display material market based on display technology in 2016. Manufacturing an LCD display panel requires more materials, layers, or components - 2 layers of substrates and polarizers are used in LCDs compared with a single layer of each in OLED; also color filter layer, liquid crystals, and backlighting units are used in LCDs, which are not required in OLED displays. The display market has witnessed a rapid increase in the adoption of OLED panels in smartphones and smart wearables in last 3 years. OLED display material market is expected to grow at high CAGR during the forecast period.

Polarizing films dominated the LCD material market, accounting for the largest share in 2016. The substrate sheets followed the polarizers in terms of market share. Emitter and organic layer materials held the largest share of the OLED material market in 2016. The industry leaders are increasingly investing in the improvement of these materials to obtain enhanced energy-efficiency and increased lifetime. The OLED display material market for substrates is expected to grow at the highest CAGR during the forecast period.

Television application accounted the largest share of the LCD display material market in 2016. The demand for televisions is declining year-over-year (y-o-y) since 2015; however, the average panel size is increasing by few inches per year. This has led to the increased consumption of display materials used in LCD display panels for televisions. Smartphones and tablets contributed to the most of the demand for OLED display materials in 2016; however, the growth of the market is expected to be driven by the televisions, where ~10 million units are expected to be shipped by 2023. This would eventually contribute to the production of more than 9 million square meter panel area by 2023. Driven by LG, the market for OLED-based display panels for television application is expected to grow exponentially, in terms of unit shipments.

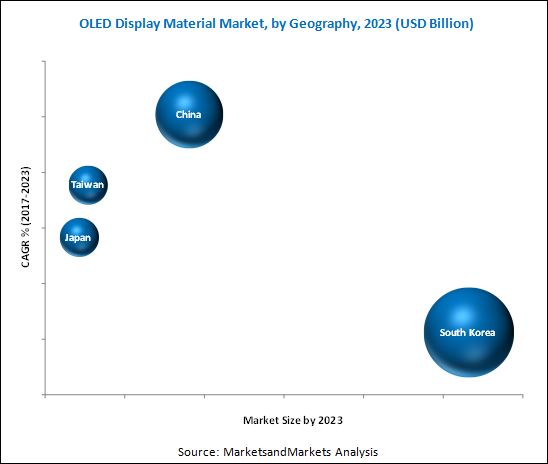

South Korea accounted for the largest share of display material market in 2016 owing to the presence of industry leaders such as Samsung and LG in the country. The demand for display materials from China is expected to increase rapidly during the forecast period as various Chinese players have undertaken the construction of several LCD and OLED plants. A large number of operations related to LCD displays are being shifted to Mainland China owing to the favorable government policies and lower costs associated with logistics operations concerning the delivery of end products in the display panel market.

A major deterrent for the growth of the display material market is the exclusivity and IP protection of emerging and advanced display materials. This causes exclusivity and prevents entry of other players in the market.

Samsung SDI (South Korea), LG Chem (South Korea), Sumitomo Chemical (Japan), Corning (US), Nitto Denko (Japan), Universal Display Corporation (US), Merck (Germany), Asahi Glass (Japan), Idemitsu Kosan (Japan), DowDuPont (US), Toray (Japan), DIC Corporation (Japan), Hodogaya Chemical (Japan), and JSR Corporation (Japan) are the leading players in the market and have adopted various strategies such as product launches and developments, partnerships, collaborations, business expansions, and mergers to sustain in the display material market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst